Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

cfa-level-2portfolio-management

01 Aug 2021

Active Risk

Active return refers to the return on the portfolio above the return on the benchmark. That is,

$$ \text{Active return} = R_P-R_b $$

Active risk, also known traditionally as tracking error or tracking risk, is a risk that a portfolio manager creates in an attempt to outperform benchmark returns against which it is compared. In addition, active risk helps a portfolio manager achieve higher returns for investors. In other words, it is the standard deviation of active returns.

Measuring Active Risk

$$ \text{Active risk} = \text{Tracking error (TE)} = s(R_P-R_b) $$

Where:

- S is the sample standard deviation.

- \(R_P\) is the return of the portfolio.

- \(R_b\) is the benchmark return.

Tracking Risk and Information Ratio (IR)

Information ratio (IR) is a measure of returns of a portfolio beyond the returns of a benchmark in comparison with the returns’ volatility. Strictly speaking, a benchmark is typically an index representing the market or a particular sector.

Information Ratio (IR) is used as a measure of a portfolio manager’s skills and ability to generate excess returns relative to a benchmark. It also identifies the consistency of performance by incorporating a tracking risk component into the calculation.

Tracking risk identifies the level of consistency with which a portfolio follows the performance of a benchmark. A low tracking risk implies that a portfolio is closely following the benchmark. A high tracking error implies that a portfolio is volatile relative to the benchmark and that returns are drifting from the benchmark. Investors prefer a low tracking error.

Information Risk (IR) Formula

Although compared funds may be different, the information risk (IR) formula standardizes the returns by dividing the difference in their performances by their tracking risk.

$$ {IR} =\frac{\bar{R_p}-\bar{R_b}}{S(R_P-R_b) } $$

where:

- \(\bar{R_p}\) is the average of the portfolio returns for the chosen periods.

- \(\bar{R_b}\) is the average of the benchmark returns for the chosen periods.

Question

Using the following data to calculate the manager’s information ratio:

$$ \begin{array}{c|c|c} \textbf{Period} & \bf{\text{Portfolio Returns } ({R}_{p})} & \bf{\text{Benchmark Returns }({R}_{b})} \\ \hline 1 & 0.0211 & 0.0111 \\ \hline 2 & 0.0091 & 0.0112 \\ \hline 3 & 0.0128 & 0.0091 \\ \hline 4 & 0.0083 & 0.0092 \\ \hline 5 & 0.0160 & 0.0111 \\ \hline 6 & 0.0191 & 0.0183 \end{array} $$

Which of the following is most likely correct about the portfolio in question relative to the benchmark?

- It is close to the benchmark.

- It is volatile relative to the benchmark.

- It has a low information ratio.

Solution

The correct answer is B.

$$ \begin{array}{c|c|c|c} \textbf{Period} & \bf{\text{Portfolio}} & \bf{\text{Benchmark}} & \bf{{R}_{p}-{R}_{b}} \\ & \textbf{returns} & \textbf{returns} & \\ & \bf{({R}_{p})} & \bf{({R}_{b})} & \\ \hline 1 & 0.0211 & 0.0111 & 0.0100 \\ \hline 2 & 0.0091 & 0.0112 & (0.0021) \\ \hline 3 & 0.0128 & 0.0091 & 0.0037 \\ \hline 4 & 0.0083 & 0.0092 & (0.0009) \\ \hline 5 & 0.0160 & 0.0111 & 0.0049 \\ \hline 6 & 0.0191 & 0.0183 & 0.0008 \\ \hline \textbf{Average} & \bf{0.0144} & \bf{0.0117} & \bf{0.0027} \\ \hline \textbf{Standard} & & & \bf{0.0041} \\ \textbf{Deviation} & & & \\ \end{array} $$

$$ \begin{align*} {IR} &=\frac{{\bar{R}}_P-{\bar{R}}_b}{S(R_P-R_b) } \\ & =\frac{0.0144-0.0117}{0.0041}=0.6585\approx\ 0.66 \end{align*} $$

The high information ratio implies that the portfolio is volatile relative to the benchmark.

A is incorrect.The high information ratio shows that the portfolio is not closely following the benchmark.

C is incorrect.Investors prefer a portfolio with a low information ratio.

Reading 40: Using Multifactor Models

LOS 40 (e) Explain sources of active risk and interpret tracking risk and the information ratio.

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

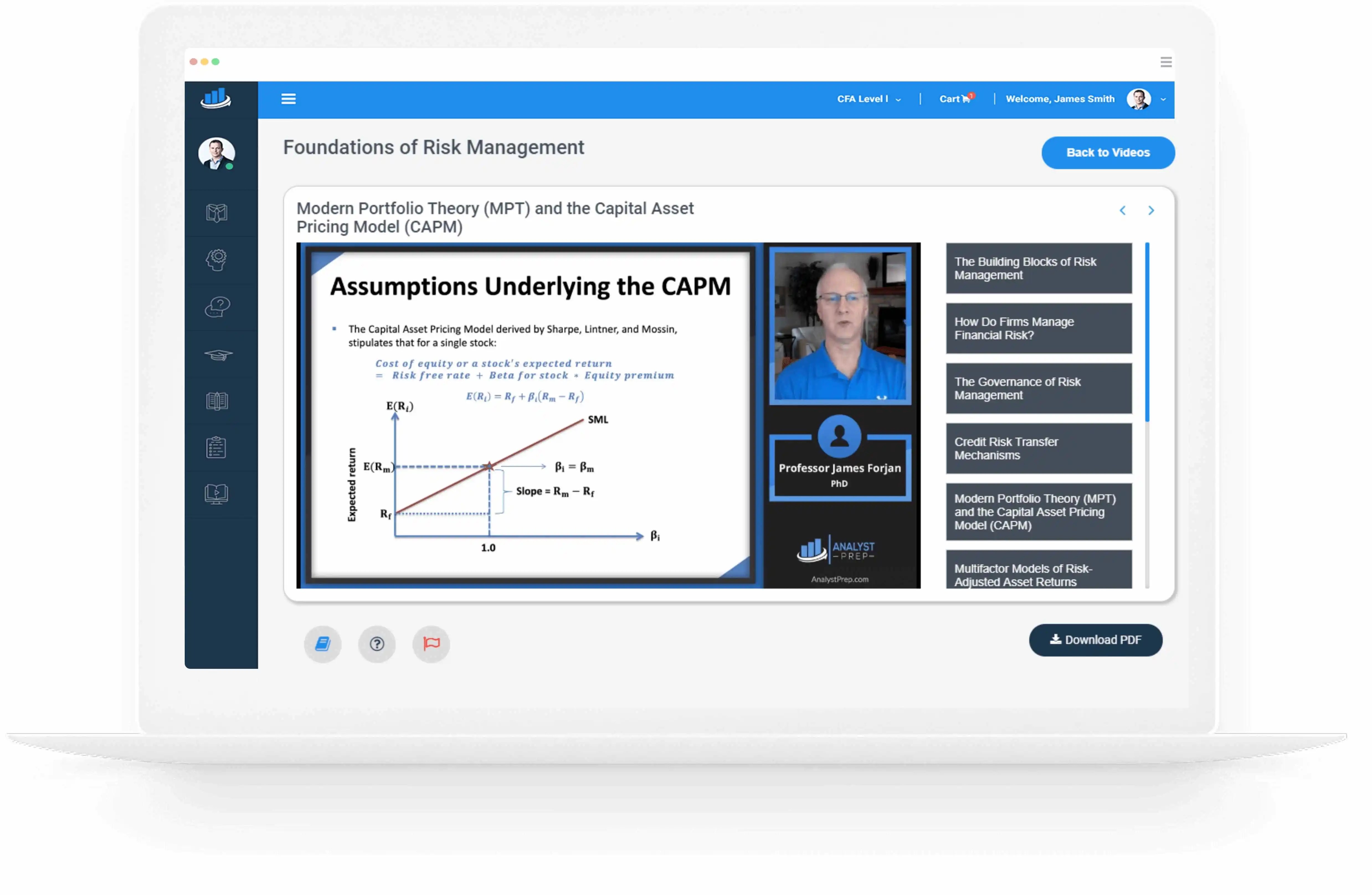

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Nyka Smith

2021-02-18

Every concept is very well explained by Nilay Arun. kudos to you man!

Badr Moubile

2021-02-13

Very helpfull!

Agustin Olcese

2021-01-27

Excellent explantions, very clear!

Jaak Jay

2021-01-14

Awesome content, kudos to Prof.James Frojan

sindhushree reddy

2021-01-07

Crisp and short ppt of Frm chapters and great explanation with examples.

Trustpilot rating score: 4.7 of 5, based on 61 reviews.

Related Posts